Introduction to Technical Analysis

What is Technical Analysis?

Technical analysis is a method used to evaluate and predict the future price movements of financial instruments by analyzing historical market data, primarily price and volume. Unlike fundamental analysis, which focuses on a company’s financial statements and economic factors, technical analysis is rooted in the belief that historical trading activity and price changes can be valuable indicators of future price movements.

Why Use Technical Analysis?

Traders and investors use technical analysis to identify trading opportunities and make informed decisions. By studying chart patterns and technical indicators, they aim to understand market sentiment and potential price trends, enabling them to enter and exit trades at optimal times.

Understanding Chart Patterns

The Role of Chart Patterns in Trading

Chart patterns are formations created by the price movements of a security on a chart. These patterns help traders predict future price movements based on historical patterns. Recognizing these patterns can provide insights into market psychology and potential trend reversals or continuations.

Common Types of Chart Patterns

Chart patterns are generally categorized into two types:

- Reversal Patterns: Indicate a change in the prevailing trend.

- Continuation Patterns: Suggest that the current trend will continue.

Key Chart Patterns Explained

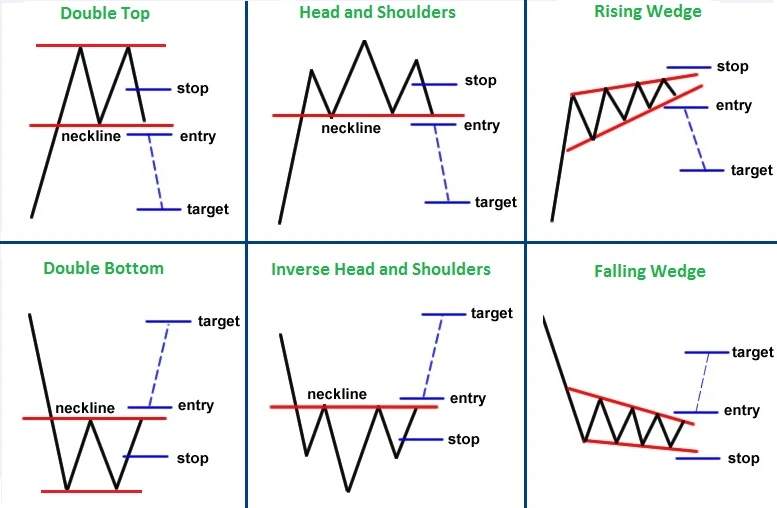

Head and Shoulders

The Head and Shoulders pattern is a reversal pattern that signals a change in trend direction. It consists of three peaks: a higher peak (head) between two lower peaks (shoulders). A break below the neckline (support level) confirms the pattern, indicating a potential bearish reversal.

Double Top and Double Bottom

- Double Top: A bearish reversal pattern formed after an uptrend, characterized by two peaks at approximately the same level. A break below the support level confirms the pattern.

- Double Bottom: A bullish reversal pattern formed after a downtrend, featuring two troughs at similar levels. A break above the resistance level confirms the pattern.

Triangles (Ascending, Descending, Symmetrical)

- Ascending Triangle: A bullish continuation pattern with a horizontal resistance line and an ascending support line. A breakout above resistance suggests a potential upward move.

- Descending Triangle: A bearish continuation pattern with a horizontal support line and a descending resistance line. A breakout below support indicates a potential downward move.

- Symmetrical Triangle: A neutral pattern where both support and resistance lines converge. A breakout in either direction signals the next potential trend.

Flags and Pennants

These are short-term continuation patterns that represent brief consolidations before the previous trend resumes.

- Flag: A rectangular-shaped pattern that slopes against the prevailing trend.

- Pennant: A small symmetrical triangle that forms after a strong price movement.

Cup and Handle

The Cup and Handle is a bullish continuation pattern resembling a tea cup. The “cup” is a rounded bottom, and the “handle” is a short consolidation period. A breakout above the handle’s resistance suggests a potential upward move.

Introduction to Technical Indicators

What are Technical Indicators?

Technical indicators are mathematical calculations based on historical price, volume, or open interest data. They help traders identify trends, momentum, volatility, and market strength, aiding in decision-making processes.

Types of Technical Indicators

- Trend Indicators: Identify the direction and strength of a trend (e.g., Moving Averages).

- Momentum Indicators: Measure the speed of price movements (e.g., RSI, MACD).

- Volume Indicators: Analyze the strength of a price move based on volume (e.g., OBV).

- Volatility Indicators: Assess the rate of price fluctuations (e.g., Bollinger Bands).

Popular Technical Indicators

Moving Averages (SMA & EMA)

- Simple Moving Average (SMA): Calculates the average price over a specific period.

- Exponential Moving Average (EMA): Gives more weight to recent prices, making it more responsive to new information.

Moving averages help smooth out price data to identify trends over time.

Relative Strength Index (RSI)

The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. Values above 70 indicate overbought conditions, while values below 30 suggest oversold conditions.

Moving Average Convergence Divergence (MACD)

The MACD is a momentum indicator that shows the relationship between two moving averages. It helps identify potential buy and sell signals through crossovers and divergences.

Bollinger Bands

Bollinger Bands are a popular technical analysis tool developed by John Bollinger in the 1980s. They consist of three lines:Schwab+4Corporate Finance Institute+4Encyclopedia Britannica+4Investopedia+3Investopedia+3FTMO Academy+3

- Middle Band: A simple moving average (SMA), typically over 20 periods.

- Upper Band: The SMA plus two standard deviations.

- Lower Band: The SMA minus two standard deviations.Investopedia+1Wikipedia – Die freie Enzyklopädie+1

These bands adjust dynamically based on market volatility. When volatility increases, the bands widen; when volatility decreases, they contract. Fidelity Investments+2Investopedia+2Corporate Finance Institute+2Corporate Finance Institute

How to Use Bollinger Bands:

- Overbought/Oversold Conditions: Prices touching the upper band may indicate an overbought market, while touching the lower band may suggest an oversold market.

- Volatility Analysis: Narrowing bands can signal a period of low volatility, potentially preceding a significant price movement.

- Trend Identification: A price consistently hugging the upper band suggests a strong uptrend, while hugging the lower band indicates a strong downtrend.

Traders often use Bollinger Bands in conjunction with other indicators, such as the Relative Strength Index (RSI), to confirm signals and improve trading decisions. Investopedia

Volume Indicators (OBV, Volume Oscillator)

Volume indicators are essential tools in technical analysis, providing insights into the strength of price movements by analyzing trading volume. Two widely used volume indicators are On-Balance Volume (OBV) and the Volume Oscillator.

On-Balance Volume (OBV)

OBV is a momentum indicator that relates volume to price changes. It operates on the premise that volume precedes price movement, meaning that significant changes in volume can signal upcoming price shifts. The OBV is calculated by adding the day’s volume to a cumulative total when the price closes higher than the previous day and subtracting it when the price closes lower.

How to Use OBV:

- Trend Confirmation: If both price and OBV are rising, it confirms an upward trend. Conversely, if both are falling, it confirms a downward trend.

- Divergence Detection: If the price is rising but OBV is falling, it may indicate a potential reversal. Similarly, if the price is falling but OBV is rising, it could signal a bullish reversal.

Volume Oscillator

The Volume Oscillator measures the difference between two volume moving averages, typically a short-term and a long-term average. It helps identify whether volume is increasing or decreasing, providing insights into the strength of a price trend.

How to Use Volume Oscillator:

- Positive Values: Indicate that short-term volume is higher than long-term volume, suggesting increasing interest and potential continuation of the current trend.

- Negative Values: Suggest that short-term volume is lower than long-term volume, indicating waning interest and potential trend reversal.

By incorporating volume indicators like OBV and the Volume Oscillator into your analysis, you can gain a deeper understanding of market dynamics and enhance your trading decisions.

Combining Chart Patterns and Indicators

While chart patterns and technical indicators can be powerful tools individually, combining them can provide more robust trading signals and reduce the likelihood of false positives.

Confirming Signals

Using multiple indicators in conjunction can help confirm potential trading opportunities. For example:

- Head and Shoulders Pattern with RSI: If a Head and Shoulders pattern forms and the RSI indicates overbought conditions, it strengthens the case for a potential downward reversal.

- Double Bottom with MACD: A Double Bottom pattern accompanied by a bullish MACD crossover can confirm a potential upward reversal.

Avoiding False Signals

Relying on a single indicator can sometimes lead to false signals. By combining indicators, you can filter out noise and make more informed decisions. For instance:

- Bollinger Bands and Volume: A price breakout beyond Bollinger Bands accompanied by high volume is more likely to be sustained than one with low volume.

- Moving Averages and MACD: A bullish crossover in moving averages confirmed by a MACD crossover can provide a stronger buy signal.

By integrating multiple tools, traders can enhance their analysis and improve the accuracy of their trading strategies.

Practical Tips for Beginners

Embarking on technical analysis can be daunting, but with the right approach, beginners can build a solid foundation.

Start with a Demo Account

Before risking real capital, practice your strategies on a demo account. This allows you to familiarize yourself with trading platforms, test your analysis, and gain confidence without financial risk.

Keep a Trading Journal

Documenting your trades helps you track your performance, identify patterns in your decision-making, and learn from both successes and mistakes. Include details like entry and exit points, reasons for the trade, and outcomes.

Continuous Learning and Practice

The markets are dynamic, and continuous learning is vital. Stay updated with market news, attend webinars, read trading books, and engage with trading communities to enhance your knowledge and skills.

Conclusion

Technical analysis, encompassing chart patterns and indicators, offers traders a structured approach to understanding market behavior and making informed decisions. By mastering these tools and combining them effectively, traders can enhance their ability to identify opportunities and manage risks. Remember, consistent practice, continuous learning, and disciplined execution are key to success in the trading world.

FAQs

Q1: What is the difference between a simple and exponential moving average?

A simple moving average (SMA) calculates the average price over a specific period, giving equal weight to all data points. An exponential moving average (EMA) gives more weight to recent prices, making it more responsive to recent market movements.

Q2: Can technical analysis be used for long-term investing?

Yes, technical analysis can be applied to long-term investing to identify entry and exit points, confirm trends, and manage risks. However, it’s often combined with fundamental analysis for a comprehensive approach.

Q3: How reliable are chart patterns in predicting market movements?

Chart patterns can provide valuable insights into potential market movements, but they are not foolproof. It’s essential to use them in conjunction with other indicators and risk management strategies.

Q4: What is the best time frame for technical analysis?

The best time frame depends on your trading style. Day traders may focus on intraday charts (e.g., 5-minute, 15-minute), swing traders on daily charts, and long-term investors on weekly or monthly charts.

Q5: Do technical indicators work in all market conditions?

Technical indicators can be effective in various market conditions, but their reliability may vary. It’s crucial to understand the strengths and limitations of each indicator and adapt your strategy accordingly.